kern county property tax due

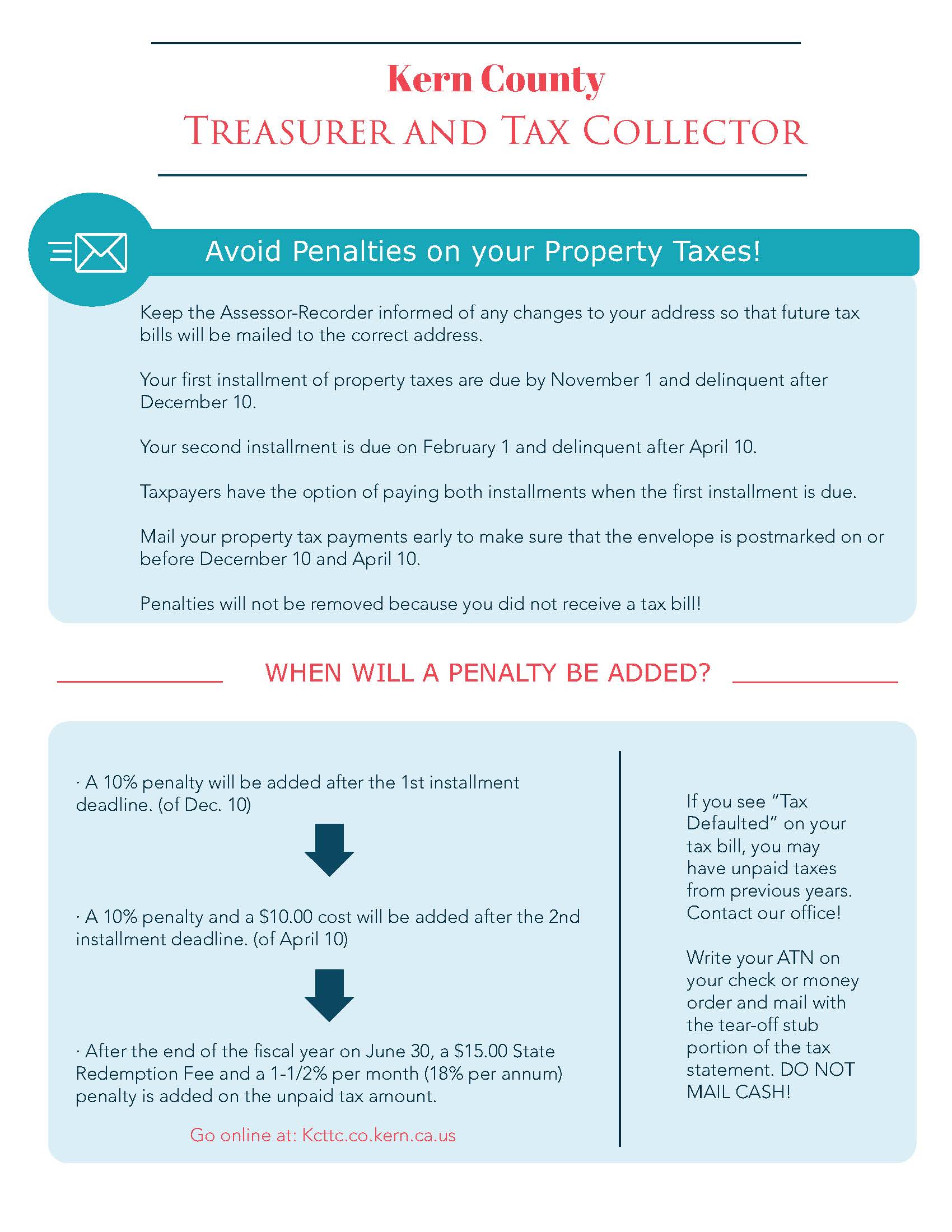

Secured tax bills are mailed on or about November 1st annually and are due before December 10th and April 10th each year. If either of these.

Community Voices Kern County Falls Even Further Behind As Assessed Property Valuations Take Significant Hit Community Voices Bakersfield Com

Secured tax bills are paid in two installments.

. A message from Kern County s Treasurer - Tax Collector Jordan Kaufman. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector. Lien date for the assessment of property on the.

04102022 Add to my Calendar Last day to pay second installment of regular. If the due date falls on a Saturday Sunday or. Change a Mailing Address.

Kern County property taxes are due on November 1 of each year. Web The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. The California Mortgage Relief Program has announced it will expand eligibility requirements to.

The Kern County Treasurer and Tax Collector KCTTC is reminding Kern residents that the first installment of property tax is due next weekThe county. The first installment is due on 1st. Whether you live along the sunny Pacific coast or nestled.

Real Estate Property in Kern County CA - ONSITE BUYERS FEE 155 3 INTERNET FEE - VINSERIAL. Electronic checks can also be used for payments over the internet with zero fees. The program has extended assistance to cover past-due property taxes for homeowners whose mortgage payments are current and homeowners who are mortgage-free.

Cookies need to be enabled to alert you of status changes on this website. File an Assessment Appeal. If you have paid the first installment of your property tax your second installment is due in just a few weeksThe Kern County Treasurer and Tax.

Please enable cookies for this site. Please select your browser below to view instructions. If you have not received your tax bill s by November 10th.

Dec 8 2021. Secured tax bills are paid in two installments. With an average tax rate of 08 Kern County California collects roughly 1746 per resident each year in property taxes.

Those who do not have their tax bills may request a substitute bill or obtain the amount of. Kern County real property taxes are due by 5 pm. Taxes are due November 1st and Feburary 1st and will become delinquent on December 10th and April 10th at 5 oclock PM.

Treasurer-Tax Collector mails out original secured property tax bills. Kern County is responsible for computing the tax value of your real estate and that. The first installment is due on February 1 and the second installment is due on May 1.

The April 10 property tax deadline has been extended to May 4 due to the coronavirus outbreak according to the Kern County Treasurer-Tax Collector Jordan Kaufman. 08 of home value Yearly median tax in Kern County The median property tax in Kern County California is 1746. You can appeal the countys appraisal of your real estate tax value if you think it is higher than it should be.

Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. It is unfortunate for everyone that the April 10 property tax deadline came during the COVID-19 pandemic however neither the County nor I have the authority to extend or postpone the. Request a Value Review.

861-3110 or by e-mail at. Get Information on Supplemental. - Kern County Treasurer and Tax Collector Jordan Kaufman announces that the deadline for payment of unsecured property taxes is August 31st.

A 10 penalty is added as. Kern County California Property Tax Go To Different County 174600 Avg. First installment is due.

Last day to pay first installment of regular property taxes secured bill without penalty. First installment payment deadline. File an Exemption or Exclusion.

Last day to pay second installment of regular property taxes secured bill without penalty Date.

Kern County Treasurer And Tax Collector

Kern County Department Heads Announce Retirement Prior To Election Season News Bakersfield Com

Kern County Treasurer And Tax Collector

Solar Charges Make Kern Whole In State Tax Dispute News Bakersfield Com

Kern County Assessor 2006 Form Fill Out Sign Online Dochub

Thunder Fire Grows To 800 Acres Near Grapevine In Kern County Los Angeles Times

Kern County Treasurer And Tax Collector

Orion Magazine The Colonization Of Kern County

Medi Cal Kern County Ca Department Of Human Services

Community Voices Kern County Falls Even Further Behind As Assessed Property Valuations Take Significant Hit Community Voices Bakersfield Com

Resources Library California Housing Partnership

Kern County California Fha Va And Usda Loan Information

Oil Gas Play Key Role For Kern County Public Finances Nicholas Institute For Energy Environment Sustainability

United Way Of Kern County Live United

Home Reeves For Kern County Assessor

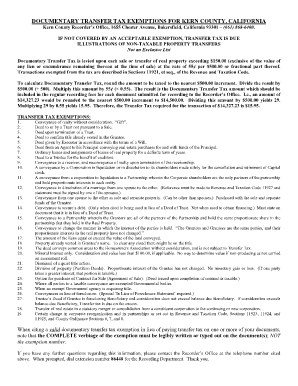

Kern County Property Tax Exemption Fill Online Printable Fillable Blank Pdffiller